How to Use Motivational Interviewing to Help Your Clients Make Decisions

This article is contributed by Joselyn Hall and Lynn James, co-founders of TrueSquid, offering Wealth & Wellness coaching and training to top performing advisors.

Let’s face it, all decisions require a little positive change talk. This is especially true for financial decisions. Making a decision means choosing a path forward that often requires doing something new or looking at the status quo from a fresh perspective. In working with advisors, we learned that “getting clients to do what we ask” is a common point of frustration. Often, advisors feel like they’re nagging clients to do what they know to be in the client’s best interest.

If you’re tired of reminding a client to set up an estate plan, change their auto-deposit, or update their beneficiary information, consider Motivational Interviewing (MI). This is a tool we use in Coaching Science and it is very effective at helping people discover their own internal motivation for self-change. Often, we hear MI being used in the physical health fields with clients recovering from an addiction or to treat chronic diseases such as diabetes. MI is just as valuable when working with clients facing ambivalence around financial decisions.

To be a successful motivational interviewer, one needs training, experience and empathy. The most important quality, by far, is empathy. No one likes to be told what to do, but most enjoy having someone actively and reflectively listen to them. Empathy teaches us to listen with rapport and understanding. It doesn’t mean feeling sorry for someone or agreeing with them, it simply means creating an environment in which they feel heard.

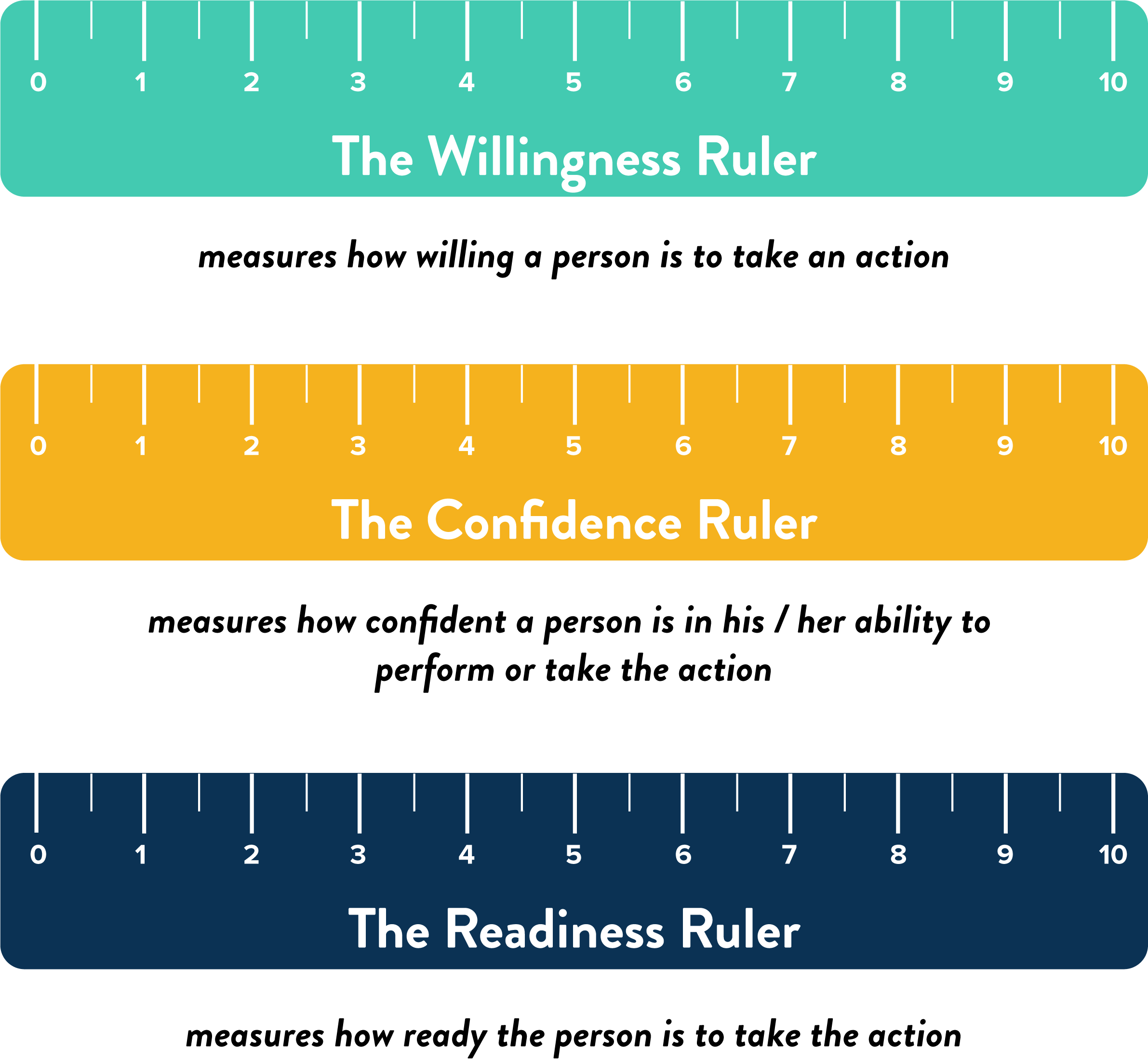

When we listen with empathy, clients are more likely to share their true feelings about the challenges they face. We use three simple rulers to help clients discover for themselves their challenges and motivations:

Each ruler can be used as a guide for clients to define their level of willingness, confidence, and readiness tied to a specific action or decision. For example, an advisor client of ours had been working with an investor for several years. During one of their first meetings, the client told his advisor that he wanted to add an update to his estate plan to the agenda. Each year, the advisor would ask for an update on the estate plan and each year the investor would skirt the topic and make excuses for his lack of progress.

After working with us, the advisor learned about MI and the three rulers. This time she used them with her client. She asked, “on a scale of 1 – 10 with 10 being the highest, how willing are you to create your estate plan?” The client answered with a solid 10. Next, the advisor asked about confidence, again, the client answered “10”. Finally, the advisor asked about readiness.

Here, the client answered with a “2”. As a follow-up, the advisor used an open-ended question – “what would need to happen to move you up to a ‘4’”? The client thought about his answer and reflected that philosophically, he wasn’t ready to think about his death and practically, he didn’t know where to start to get his estate plan completed. He didn’t know how to choose an estate planning attorney and the thought of making that decision put him into decision paralysis.

Now that the advisor knew more about the client’s hurdles, she was able to help him. She offered to give him three names for an estate planning attorney they could call together to get the process started. She followed up with a specific goal and soon the client felt empowered to move forward on a goal that had been nagging him for years.

Motivational Interviewing can help clients articulate their challenges and find a tangible next step. MI can also enable advisors to shift the emphasis from nagging to positive change talk, resulting in a more productive interaction and client relationship.